1 Introduction to the FSM telecommunications market

The FSM telecommunications sector has five key stakeholders:

▪ FSM Government (Department of Transportation, Communications and Infrastructure): Oversees the sector and sets telecommunication policy

▪ FSM Telecommunication Regulation Authority (TRA): We are the sector regulator responsible for ensuring fair competition and protecting consumer rights. You can read more about who we are and what we do in the About Us section of this website

▪ FSM Telecommunications Cable Corporation (CableCorp): The government-owned wholesale-only service provider in the FSM. CableCorp manages FSMs subsea fiber cables. It is also building an open-access fiber optic network to reach most households and businesses on FSM’s main islands. CableCorp is prohibited from providing retail services by law.

▪ Telecommunication service providers: Provide retail internet, phone, and mobile services to consumers. A list of active service providers is provided in section 4.2 and 5.2

▪ Consumers: The FSM general public who use and rely on telecommunication services.

2 How to enter the market

Table 2.1: Step-by-step guide for how to enter the FSM Telecommunications market

Step Description

1 Decide what type of service you will provide and how you will provide it

▪ This will determine what license(s) and access arrangements you will need

▪ Services include internet, mobile telephony, fixed telephony

2 Research local business requirements

▪ Understand what you need to operate a business in the FSM

▪ For example, consider the need for visas, licenses, registrations, and local premises

3 Register as a business

▪ You are required to be registered as a business to apply for a telecommunications license in the FSM

▪ You can access the application form here <hyperlink> https://www.roc.doj.gov.fm/index.php/services/forms

▪ Note the TRA is not involved in the registration process. If you need advice, contact the Registrar of Corporations here: Contact us (gov.fm)

4 Apply to the TRA for your telecommunications license(s)

▪ There are three types of licenses you may need to apply for:

– Individual license: This allows the person with the license to own network equipment and offer telecommunications services over that equipment

– Class license: This allows the person with the license to offer services over a network but not own the network equipment

– Spectrum license: You must apply for a spectrum license if you plan to offer mobile or fixed wireless services or use your own satellite for backhaul.

– You must specify the frequencies you want to use when applying for a spectrum license. You can find spectrum frequencies that are allocated for telecommunications use here: https://tra.fm/wp-content/uploads/2023/10/National-Table-of-Frequency-Allocation.pdf

– Spectrum already assigned to other licensees can be found here: https://tra.fm/public-register-of-licences/

– There are specific spectrum rules that govern spectrum operators; these can be found on this link: Spectrum-LIcensing-Rules-FINAL.pdf

▪ License applications can be made here: <hyperlink> : http://tra.fm/licence-application-forms/

– Use the operating license form if you’re applying for an operating license to own or operate a Specific Communications Network (an Individual License) or if you’re applying for a Communications Service (a Class license)

– New application fees are US$125 and Renewal application fees are US$100

▪ Note that some services are currently exempt from requiring a license, including:

– Services provided exclusively over an exempt network

– Voice and messaging services offered over the public internet that are not assigned telephone numbers by the TRA.

– The provision of satellite capacity by foreign satellite providers

▪ Exemptions are periodically reviewed and may be removed

▪ You can contact the TRA https://tra.fm/contact-us/ if you have questions about the licensing process or if you need assistance completing your license application.

5 Seek access arrangements

▪ Telecommunication providers in the FSM can build their own network infrastructure or access existing infrastructure owned by other service providers.

▪ In FSM, existing submarine cables connecting Pohnpei, Yap, and Chuuk, as well as FTTP networks in Pohnpei, Weno, and Yap, have been determined to be bottleneck facilities. The determination means that the owners of the bottleneck facilities are required, by law, to negotiate access to the infrastructure in good faith.

Read more about the bottleneck determination here https://tra.fm/wp-content/uploads/2022/05/TRA-Determination-on-Bottleneck-Facilities-Final.pdf

▪ Therefore, if you are not building and using your own network, then you will need to arrange access to an existing network for:

– International connection

– Local terrestrial distribution

In FSM, your current options are:

▪ International connectivity:

– CableCorp (subsea fiber: Guam-Pohnpei, Guam-Yap, Pohnpei-Chuuk)

– FSMTC (subsea fiber: Guam-Pohnpei)

– Satellite from a number of providers, including Kacific and Starlink

▪ Local terrestrial:

– FSMTC (FTTP) (available on Pohnpei, Chuuk (Weno), Yap Propper)

– CableCorp (Open access FTTP) (Nationwide network currently under construction)

Access arrangement process

1. Request access from existing providers

2. If access is denied, or providers are unresponsive, contact the TRA for assistance

– The TRA has template access agreements that can be put in place through a determination process

– Note that licensees must first attempt negotiation in good faith on their own terms before approaching the TRA for assistance

– By law, providers receiving an access request are required to have made reasonable attempts to agree access within 30 days of receiving the request.

6 Seek interconnection arrangements

▪ If you are offering telephony (mobile or fixed) services, you will likely want to arrange Interconnection with existing telephony providers

▪ Interconnection will allow your customers to connect locally to the customers of other providers, without incurring international call or SMS charges.

Current telephony providers in FSM:

▪ Mobile:

– FSMTC

– iBoom!

▪ Fixed:

– FSMTC

Interconnection arrangement process

1. Request Interconnection from existing providers

2. If Interconnection is denied, or providers are unresponsive, contact the TRA for assistance

– The TRA has template interconnection agreements that can be put in place through determination

– Note that licensees must first attempt negotiation in good faith on their own terms before approaching the TRA for assistance.

– By law, providers receiving an interconnection request are required to have made reasonable attempts to agree Interconnection within 30 days of receiving a request.

3 General FSM statistics

3.1.1 Population

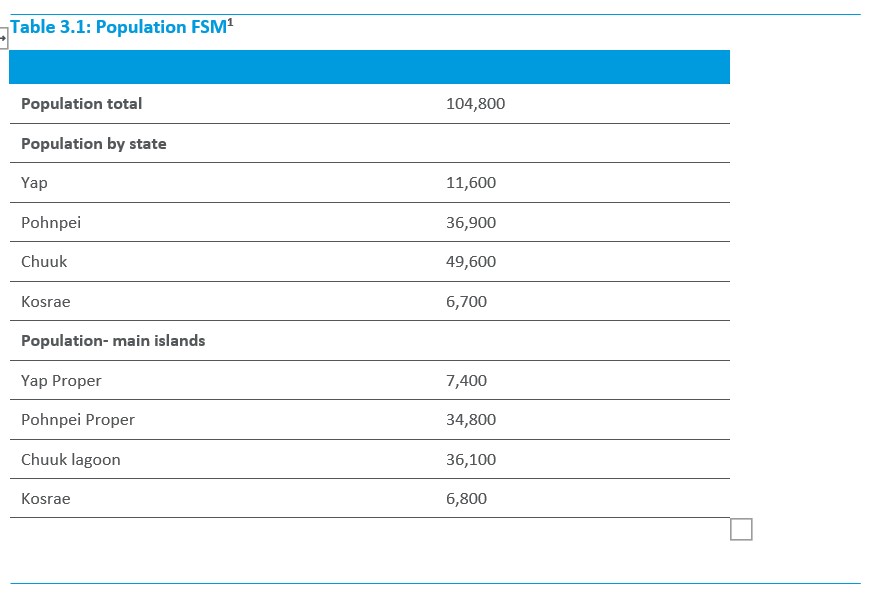

The Federated States of Micronesia is a small nation consisting of just over 100,000 people and 607 Islands.

There are over 16,500 households in FSM, with an average size of 6 people. FSM is at the early stages of the process of urbanization, with about 22 percent of its population living in the urban areas on the main islands that include Yap Proper, Pohnpei Proper, Islands in the Chuuk Lagoon, and Kosrae.

The Federated States of Micronesia comprises four states: Yap, Pohnpei, Chuuk, and Kosrae. Chuuk State is the most populous state. The many islands in FSM are diverse and contain a range of geographical features, from mountainous islands to low-lying atoll islands. The diverse geography can make it difficult to deploy telecommunication services.

The following table outlines the population of FSM by state and the populations of the main islands.

The following table outlines the population of FSM by state and the populations of the main islands.

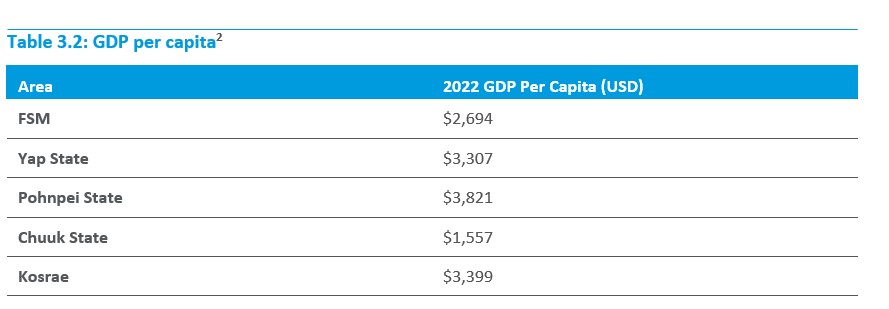

3.1.2 GDP per capita

GDP (Gross Domestic Product) measures a country’s economic production. FSM’s agriculture sector contributes the largest share of its GDP, over 15 percent. The next largest contributors are wholesale and retail trade, accounting for 13 percent, and real estate and public administration, accounting for 12 percent each.

The following table outlines the GDP per capita in FSM.

https://stats.gov.fm/topics/social/population-statistics/

https://stats.gov.fm/topics/economic-statistics/national-accounts-gdp/

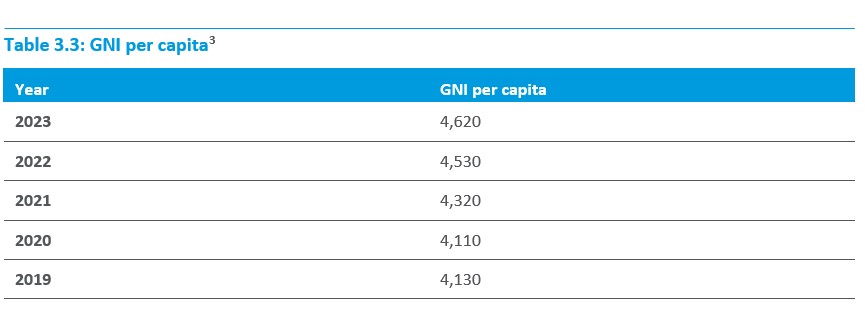

3.1.3 Gross national income (GNI)

GNI per capita measures the total dollar value of everything produced by a country and the income its residents receive, whether it is earned at home or abroad. It can be used to measure and track a nation’s wealth yearly.

The following table outlines GNI per capita over the past 5 years.

4 Mobile (tables and graphs)

4.1 Penetration

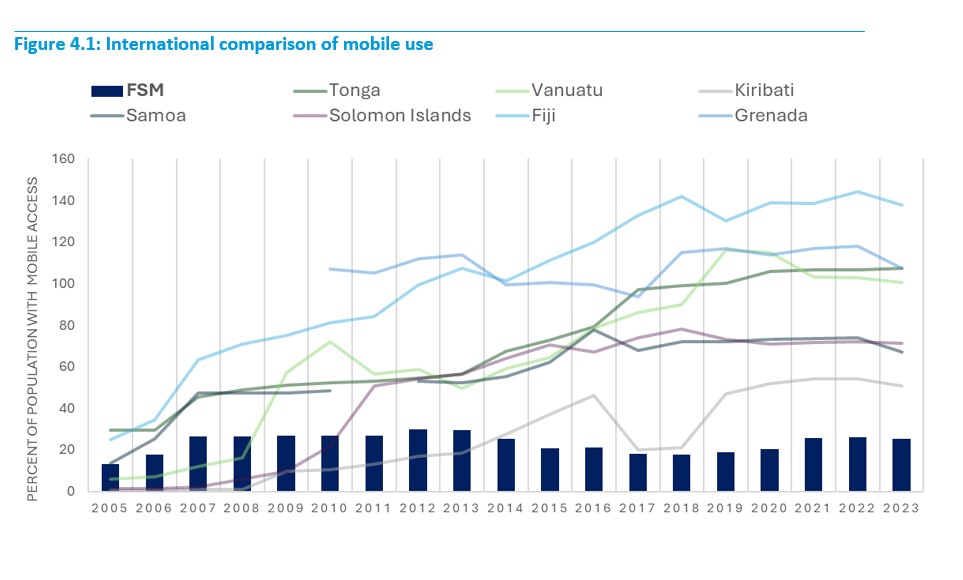

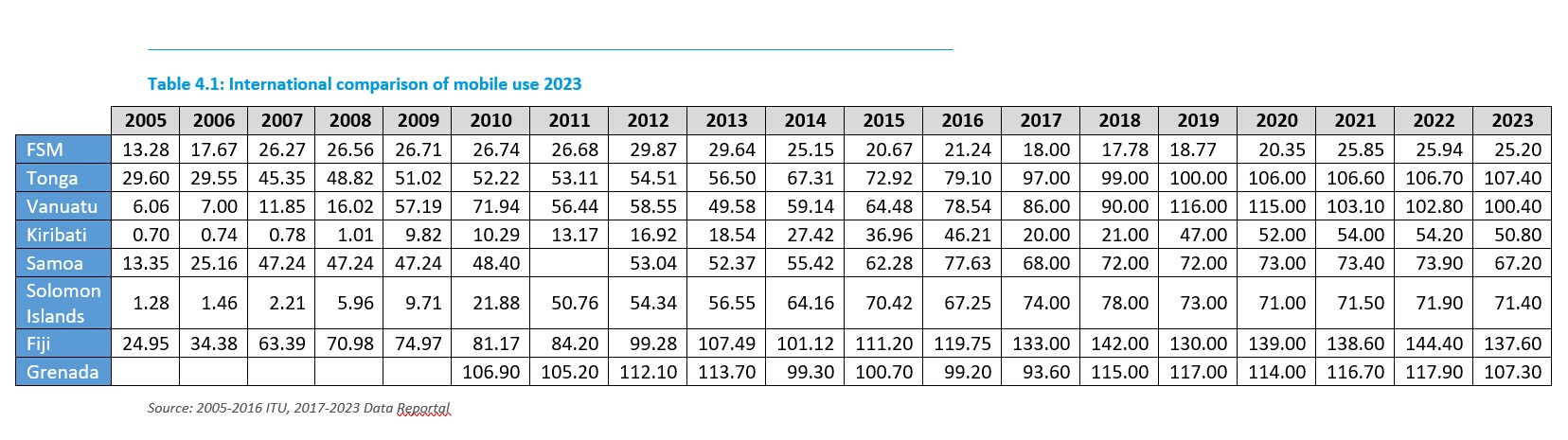

The TRA monitors mobile penetration in the Pacific. We note two significant observations:

▪ FSM’s mobile use is low—At just 25 percent of the population, FSM has the lowest mobile use out of the countries we monitor

▪ FSM mobile use is not growing—In 2005, FSM performed reasonably well compared to similar countries. However, since then, all other compared countries have had significant growth in mobile use, except for FSM, which has stayed in the 20-30 percent range.

4.2 Number of competitors

FSMTC and iBoom! are the mobile providers in FSM. FSMTC operates its mobile services across all main states, and several outer islands. iBoom! offers mobile services across Yap.

4.3 Traffic Data Trends:

4.3.1 Number of Cellular Mobile subscriptions

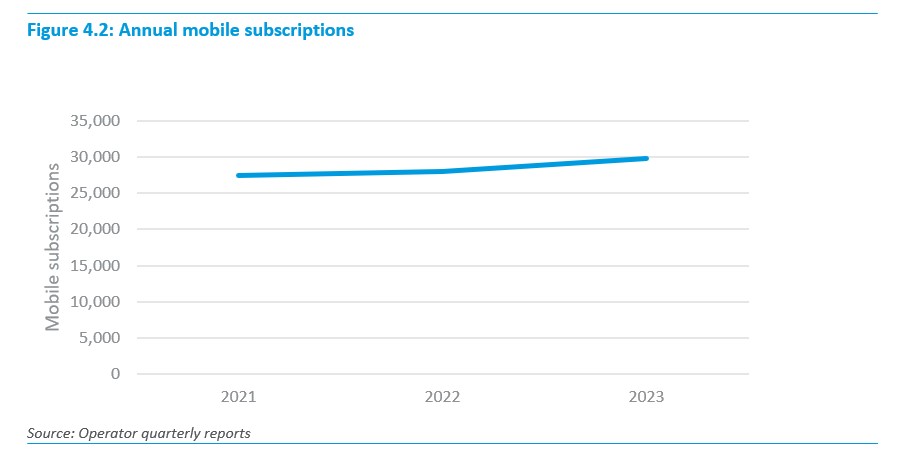

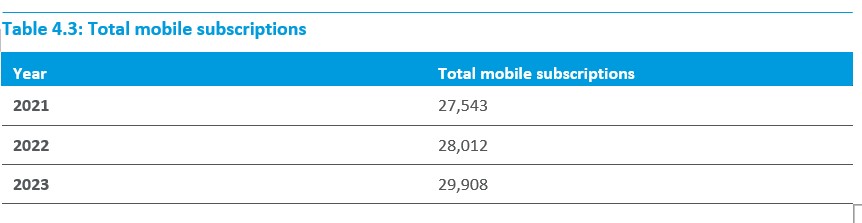

The number of mobile subscriptions in FSM has been rising yearly since 2021. Mobile services are provided across all main islands and some outer islands, including Pakin, Poluwat, Oneop, Onoun, Ahnd, Moch, Satowan, Pulap, and Parem.

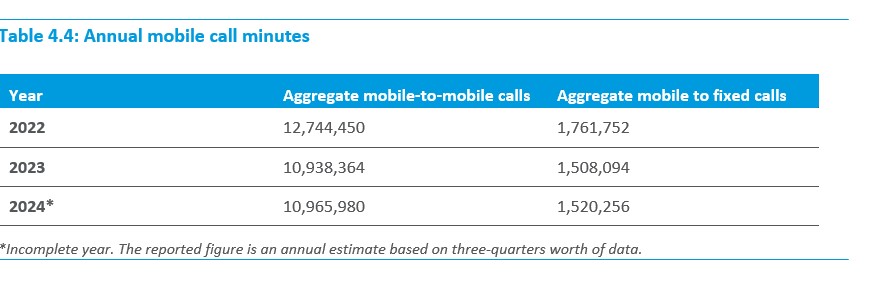

4.3.2 Number of call minutes

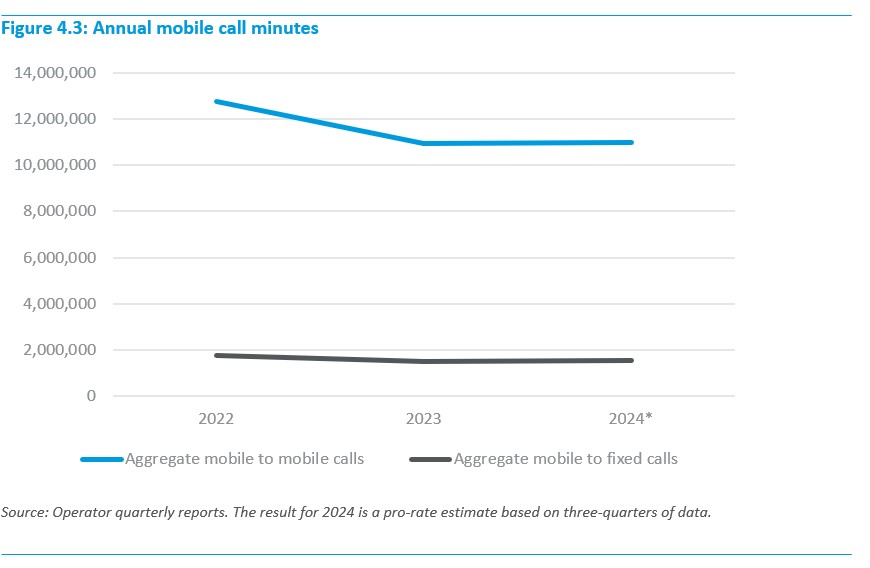

Mobile-to-mobile call minutes are significantly higher than mobile-to-fixed call minutes. This can be largely attributed to the growing prominence of mobile phones and fixed landlines becoming more obsolete as new technology is introduced.

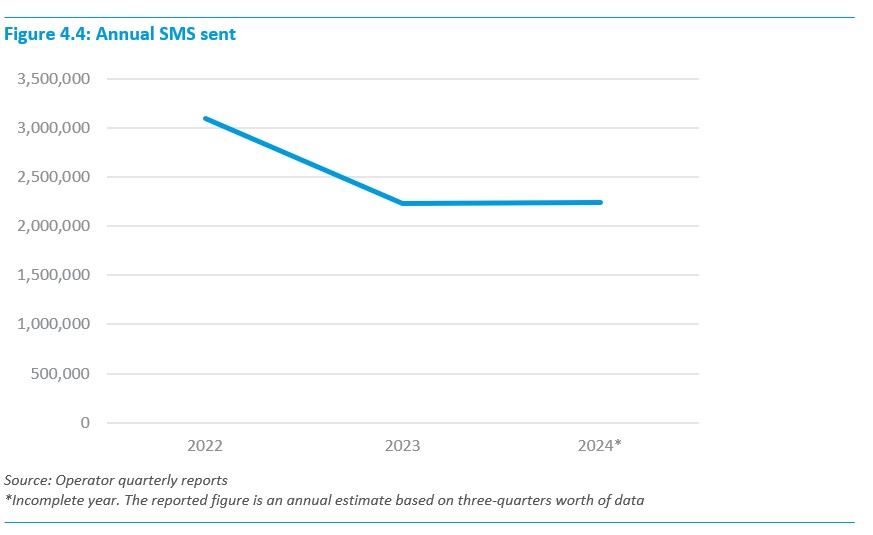

4.3.3 Number of SMS sent

SMS, more commonly known as text messaging, is a type of text message sent between mobile phones.

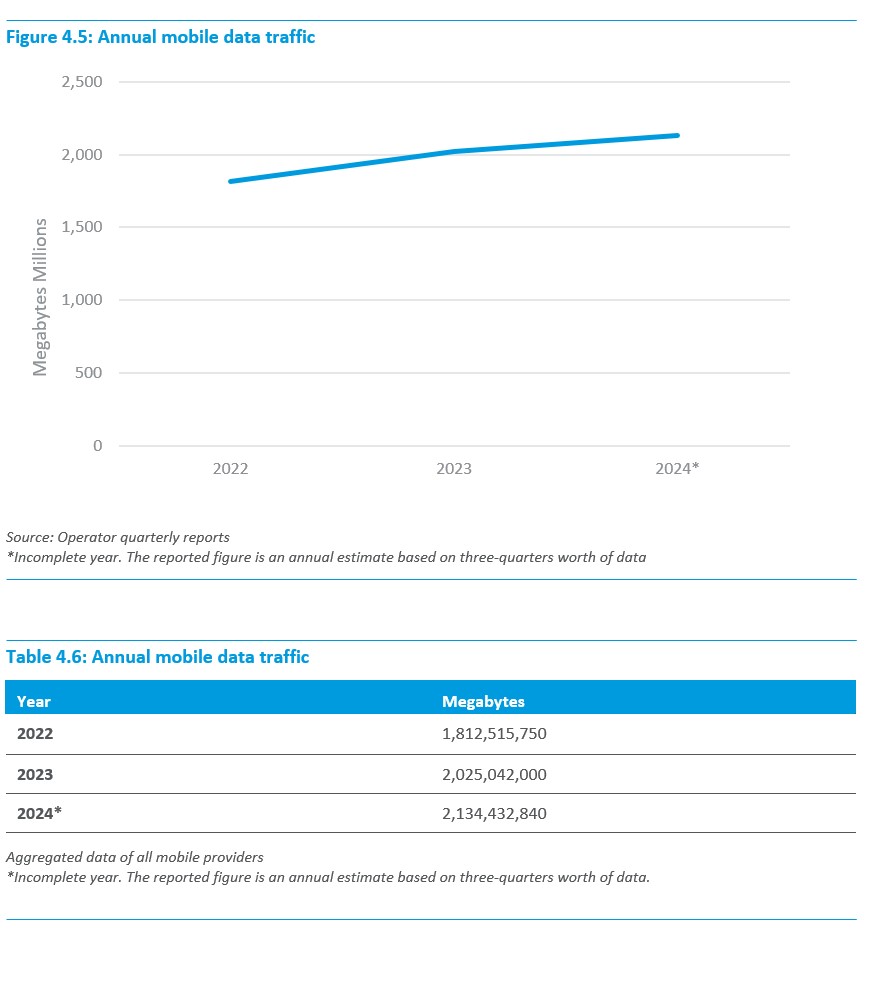

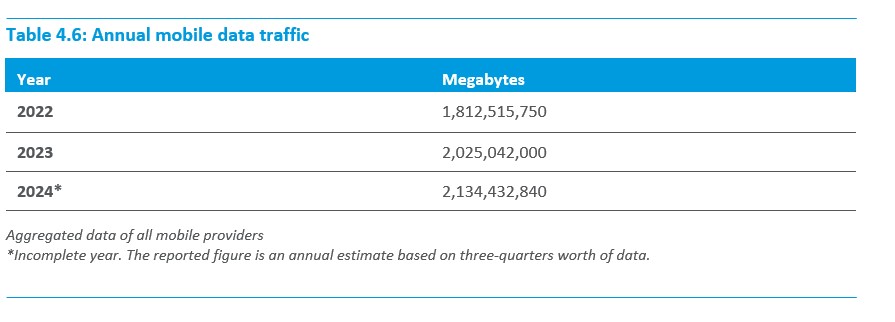

4.3.4 Mobile Data traffic

5 Fixed internet

In the FSM, Fixed Internet is provided through the following technologies:

▪ ADSL

▪ VDSL

▪ Fiber Optic

▪ Satellite

5.1 Penetration

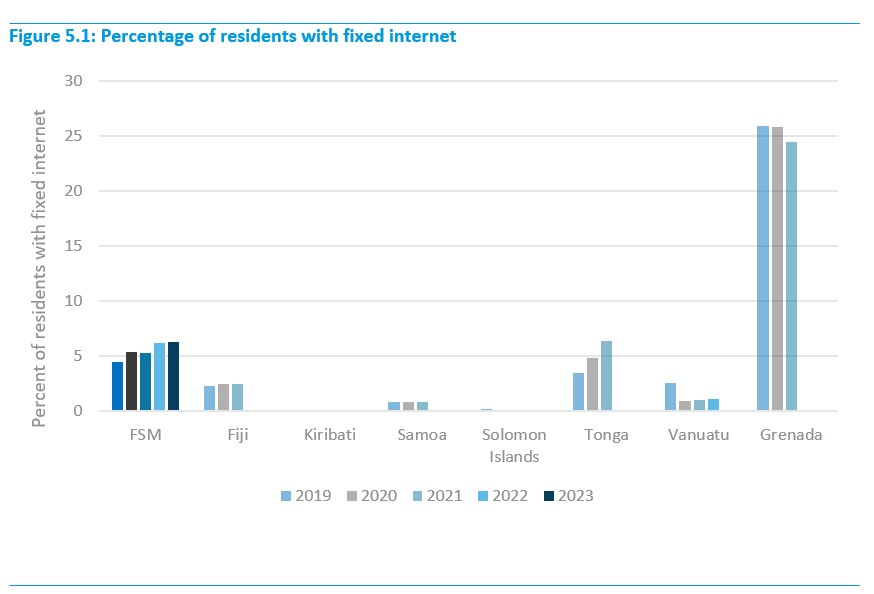

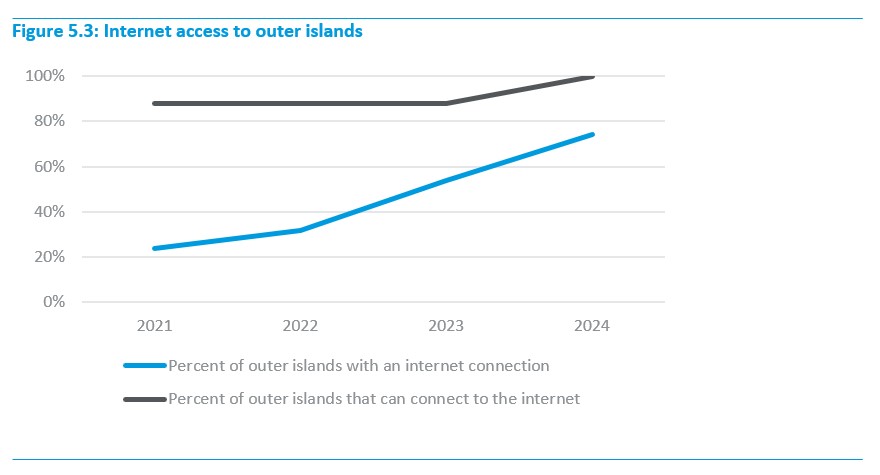

Fixed internet penetration in the FSM is relatively high when compared to most other similar countries, though still very low (below 10 percent). Comparison to Grenada shows the scale of improvement possible with a nationwide fiber to the premise (FTTP) roll out. CableCorp is currently in the process of rolling out a nationwide open access FTTP network across the main islands.

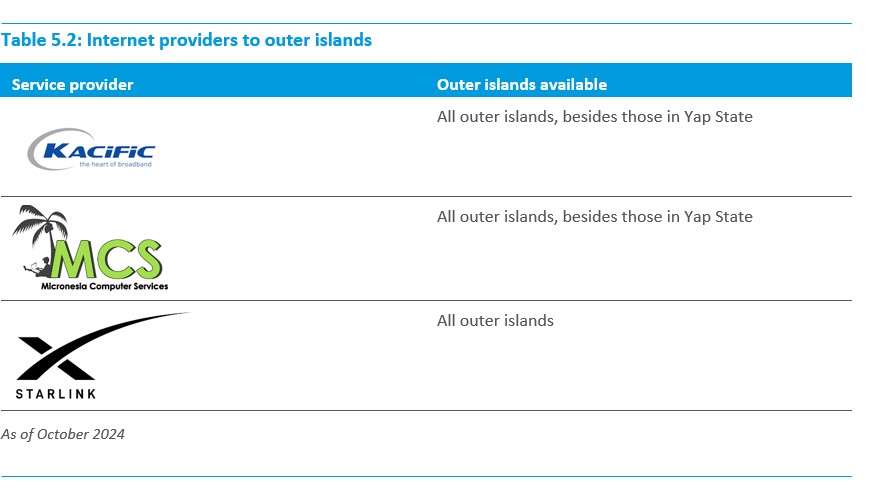

5.2 Number of competitors

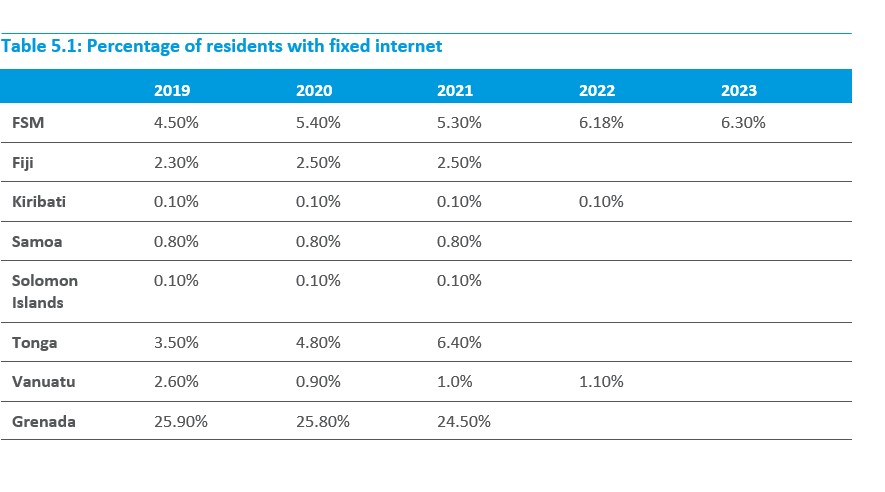

Competition in the FSM fixed internet market has been increasing over the last five years. There are now five competitors in the fixed internet market, including:

▪ Two fixed wired service providers:

– FSMTC

– iBoom!

▪ Three satellite service providers:

– Kacific

– MCS Pohnpei (a local reseller of international satellite services)

– Starlink.

5.3 Terrestrial Fiber Facilities in FSM

5.3.1 Overview of facilities

Terrestrial fiber facilities are currently owned by:

▪ FSMTC

▪ iBoom!

FSMTC has rolled out FTTP networks on Chuuk, Pohnpei and Yap. iBoom! has fiber facilities on Yap.

CableCorp provides international and interstate wholesale-only connectivity. Read more about this below.

5.3.2 Future open access fiber

As part of the sector reform initiated in 2014, CableCorp (a government-owned, wholesale-only entity) is developing an open access fiber-to-the-premise (FTTP) network for the main islands of all four states of the FSM.

Once built, Internet Service Providers will be able to access CableCorp’s FTTP network to provide retail services for consumers. The reform specified areas of Chuuk, Kosrae, Pohnpei, and Yap that will get the FTTP network. These areas are known as the “deployment area”. CableCorp is prohibited from providing retail services by law.

5.3.3 Current FTTP network

FSMTC owns and manages FTTP networks in Weno, Chuuk; Pohnpei; and Yap Propper. FSMTC’s FTTP networks are regulated and have been determined to be bottleneck facilities. FSMTC is, therefore, required to provide access to other licensees on fair terms.

iBoom! recently sought access to FSMTC’s fiber network in Yap. When initial discussions failed, the TRA stepped in and is in the process of determining a fiber access agreement for iBoom! iBoom! also has its own fiber network in Yap, which is in a point-to-point configuration.

FSMTC and iBoom have been expanding their fiber facilities in recent years. While not as expansive as the planned CableCorp network, the current facilities give us an indication of potential demand for fiber services in the FSM.

Status of current deployment

FTTP is difficult to access in FSM, and progress in expanding the fiber network has been slow over the past three years. However, the TRA expects the availability of the network to increase rapidly as construction of CableCorp’s open access FTTP network progresses in 2024 and 2025. FSMTC’s FTTP network is an encouraging sign of the potential for the future of the fiber rollout.

5.4 International connectivity

5.4.1 International connectivity options

Current connectivity options

The FSM has two international subsea fiber-optic cable connections with Guam:

▪ The Pohnpei-Guam connection, using the HANTRU-1 cable

▪ The Yap-Guam “Yap Spur” connection, using the SEA-US cable.

FSMTC and CableCorp hold IRUs for the Pohnpei-Guam connection. CableCorp holds an IRU for the Yap Spur. CableCorp also owns and manages a subsea fiber-optic cable between Pohnpei and Chuuk. CableCorp is a wholesale-only entity set up to provide open access to local and international fiber for retailers who wish to enter the FSM market.

Future connectivity options

Subsea fiber connectivity is due to be expanded to Kosrae in 2025. The East Micronesia Cable System (EMCS) is currently being constructed, and will connect Kosrae to Pohnpei.

The EMCS will provide an initial 100Gbps capacity for the FSM. Once completed, CableCorp will represent the FSM’s interest in the cable. You can read more about the EMCS here https://www.eastmicronesiacable.com/

5.4.2 International wholesale pricing methodology

CableCorp manages and provides international and interstate wholesale capacity to Chuuk, Pohnpei, and Yap, and will provide it to Kosrae once the EMCS is completed.

Service providers in FSM can purchase wholesale international and interstate connectivity from CableCorp. CableCorp is required by law to provide connectivity through its assets on “non-discriminatory and cost-based terms”. As of October 2024, CableCorp has now finalized the methodology and notified other licensees. However, the methodology has not been implemented yet. You can read more about CableCorp’s pricing methodology process here: https://fsmcable.com/news/fsmtcc-options-for-future-pricing-for-submarine-cable/

5.5 Access to outer islands

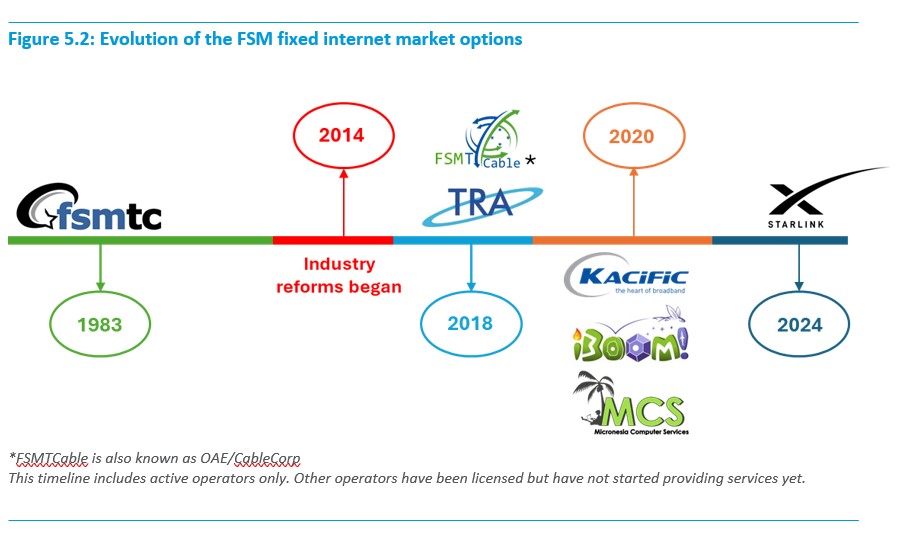

The recent arrival of low-earth-orbit (LEO) satellite constellations, such as Starlink, has increased outer island coverage from 88 percent to 100 percent. This means that consumers have the opportunity to access the internet from anywhere in the FSM as long as they have a satellite connection and a power source.

Consumers in the outer islands do not currently have access to FSM’s fiber network. Kacific and MCS Pohnpei offer satellite-based services in all outer islands besides those in Yap. The introduction of Starlink in 2024 has allowed all outer islands to access satellite internet.

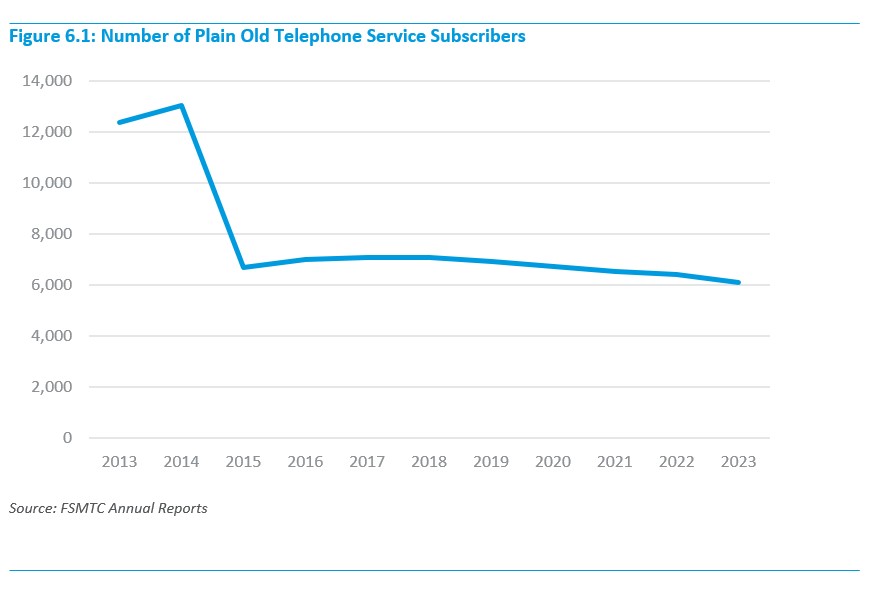

6 Fixed telephony

The number of fixed telephony subscribers is declining in the FSM. The decline is expected, as more communication happens over the internet through mobile phones and other online devices.

6.1 Fixed telephony service providers

Currently, FSMTC is the only provider of fixed telephone services in the FSM.

7 Industry retail revenues

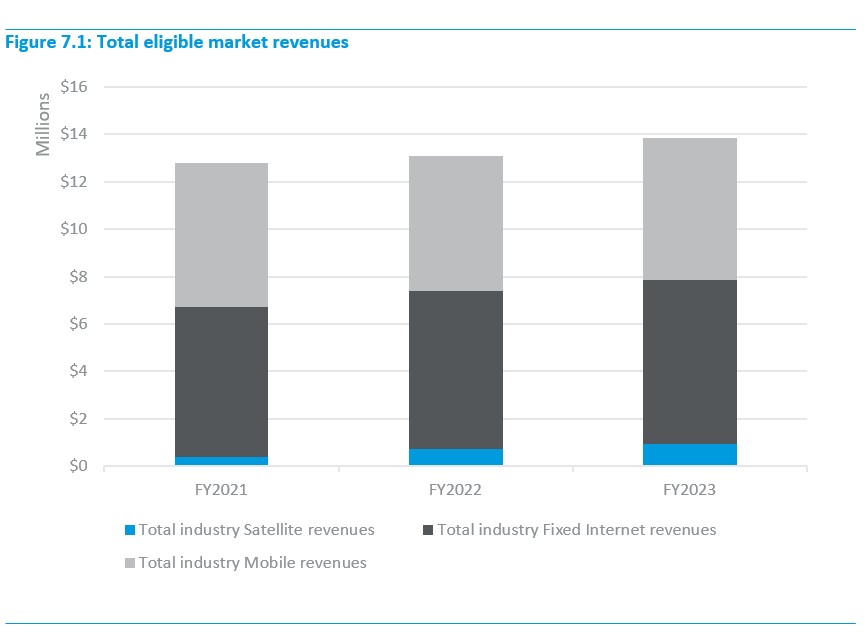

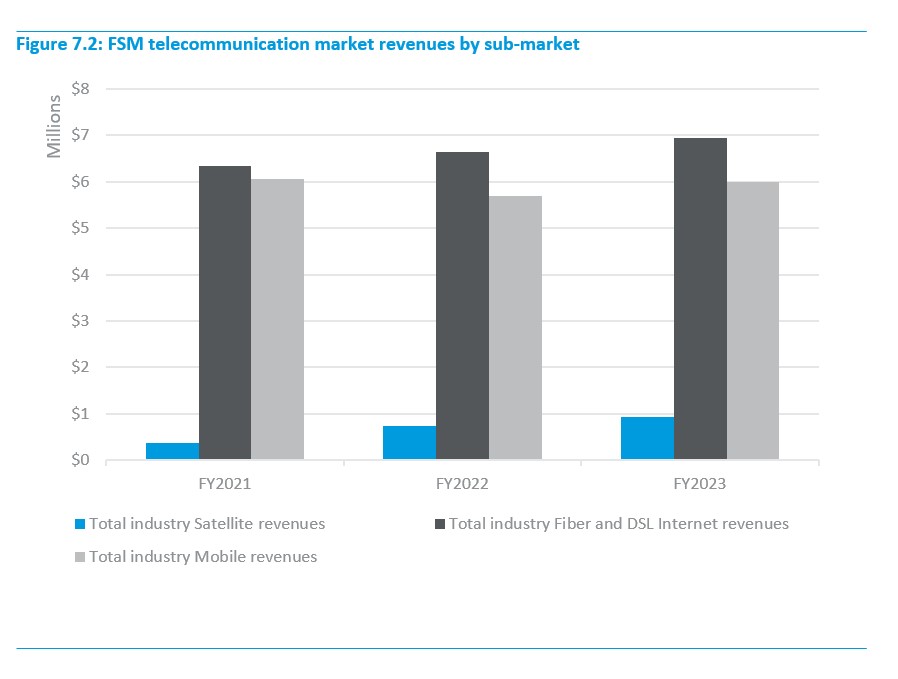

The FSM Telecommunications Market is growing, in terms of revenue. Total retail revenue, measured as revenue eligible for TRA fees, has grown seven percent from FY2021 to FY2023. Further growth is expected in FY2024.

In particular, growth has come from the Satellite Internet and Fixed Internet markets. Satellite Internet revenues have grown by 150 percent from FY2021 to FY2023. Fixed Internet revenues have grown by 9 percent from FY2021 to FY2023. Mobile revenues have declined slightly.

Satellite Internet

The Satellite Internet sub-market has shown strong growth in the past 3 years, with revenues growing 150 percent. Competition in the Satellite Internet sub-market is currently strong, with Kacific, MCS Pohnpei, and, as of FY2024, Starlink competing for customers.

Satellite Internet is a good alternative to fixed internet for customers who cannot connect to fiber networks.

Fixed Internet

The Fixed Internet sub-market has grown 9 percent in the past 3 years in terms of revenue. The Fixed Internet market is evolving, with FSMTC continuing to expand its own FTTP network FSM CableCorp starting to build its open access FTTP network, and iBoom operating in Yap.

The TRA expects fixed internet subscriptions and revenues to increase in the coming years as FTTP expands in all four states.

Mobile

Revenues for the Mobile sub-market have declined 1 percent over the past three years, with a larger decrease in FY2022, followed by an increase in FY2023.

The revenues reflect the story shown by user numbers, which shows that the mobile market is not growing. However, with a low penetration rate, the TRA expects there is significant room for growth in the Mobile sub-market when competition arrives.